What can Washington do to revive Puerto Rico's economy?

Young people protest the Puerto Rico Oversight, Management and Economic Stability Act in June. (Jose Maldonado)

It began as a small protest campground in front of the federal courthouse in Hato Rey, Puerto Rico, but it has grown in the past four months to dozens of camping tents, a small urban garden and a permanent stage in the middle of the street that’s surrounded each day by the protesters, mostly young university students, who discuss the debt crisis on the island.

Banners and spray painted messages against the Puerto Rico Fiscal Oversight Board and the “colonization” of the island by the United States, and for the priority of people before the public debt, are all around the campground, which was set up the day after President Barack Obama signed the Puerto Rico Oversight, Management and Economic Stability Act, or PROMESA, in June.

PROMESA established a seven-person board to oversee negotiations with creditors, the creation of a fiscal plan and the restructuring of the island’s $72 billion debt, including the option to use a bankruptcy-like tool. The board also has the power to determine which infrastructure and public projects are funded. The legislation outlines processes for voluntary negotiations between the Puerto Rican government and creditors, and court-supervised restructuring if those talks fail.

“We believe the Fiscal Control Board means more poverty for our people and less environmental control through deregulation of existing laws,” said Víctor Torres, one of the students at the campsite. “Despite what many people think, it is not a punishment for our politicians, but a continuation of the politics that have brought us to this point, such as limiting public services and putting private interests above the general interest, and we must reject it on all fronts.”

But despite the public protests against PROMESA, most polls reflect that a large majority of Puerto Ricans are in favor of a seven-member board taking over because of their discontent with the island’s two major political parties, who have shared the blame for the current fiscal crisis.

Puerto Rico is undergoing its worst crisis in modern history, and most experts believe that while PROMESA can help in the short term, there are not enough economic development initiatives for the island to prosper, which will require congressional action and more involvement from the U.S. government in the long term.

“There is no magic wand for reactivating our economy, but if there is no implementation of economic growth measures, if we can’t find ways to inject private investment and capital into the equation, then this will all fail because the economy will not grow,” said Puerto Rican economist Gustavo Vélez, one of the first proponents of the Fiscal Control Board.

“One of my main concerns is that when you listen to proposals made by the political candidates, they all still revolve around the old practices that got us into this mess, such as depending on loans,” Vélez added. “There is no real internal discussion about what our economic model should be, how it will fit into the new reality in the hemisphere or in the Caribbean with Cuba now being a major player.”

The board consists of four candidates submitted by Republicans and three selected by Democrats. The appointees chosen by Democrats are Arthur Gonzalez, the former chief judge of the U.S. Bankruptcy Court in Manhattan, who presided over some of the most famous corporate bankruptcy cases, including Enron, WorldCom and Chrysler; Ana Matosantos, California’s finance director from 2009 to 2013; and José Ramón González, chief executive of the Federal Home Loan Bank of New York.

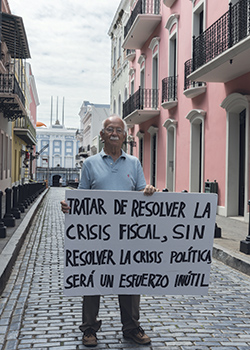

An activist calls on Puerto Rico's governor to resolve the island's political crisis. (Claudine Van Massenhove / Shutterstock.com)

The Republican-sponsored appointees are Carlos Garcia, a private-equity executive who previously served as president of the Puerto Rico Government Development Bank; Jose Carrion III, an insurance executive based in San Juan, Puerto Rico; Andrew Biggs, a fellow at the American Enterprise Institute in Washington; and David Skeel, a law professor at the University of Pennsylvania.

In its first two meetings – the first of which lasted less than 30 minutes – the Fiscal Control Board appointed Carrion as chairman and listened to Puerto Rico Gov. Alejandro García Padilla explain his fiscal plan, which he has defended against critics who say it does not address the fundamental problem of attracting new capital and lacks a clear economic development strategy.

Héctor Figueroa, president of 32BJ Service Employees International Union, said that one positive aspect of the governor’s plan is that it warns about implementing austerity measures and public employment cuts that could be even more harmful to the local economy.

“We are also against measures such as a reduction in the minimum wage to $4.15 for those under 25 years of age, which has been discussed, because the island population has the option of buying a $129 plane ticket and moving to the States to find better wages. We need to find solutions to rebuild the economy and generate new jobs,” said Figueroa, who opposed Promesa.

The effort comes as Puerto Ricans are leaving the island for the mainland United States, particularly Florida, Texas and Georgia, at a historic rate. According to the Puerto Rico Institute of Statistics, in 2014 the island lost almost 2 percent of its population, about 84,000 people, and it is currently estimated that an average of 230 people leave per day.

“Most people are yet to realize the impact of the measures that need to be taken in order to get Puerto Rico out of this fiscal crisis,” said attorney and PROMESA analyst John Mudd.

Mudd added that while the concern for austerity measures might be justified, “it is also true that there is a lot of grease to cut and the government needs to cut its costs dramatically, including its payroll, which is what the board will be looking at closely.”

Mudd points to the millions that have been paid to advisors for help in the restructuring of the debt of public companies such as the Puerto Rico Power Authority, which have yet to produce significant results.

“The problem is not how much the government is collecting, which is more than ever, the problem is how much it is spending,” Mudd said. “When you change that philosophy, like they did in Argentina, it works. You have to be more frugal and responsible in order to gain access to the markets once again.”

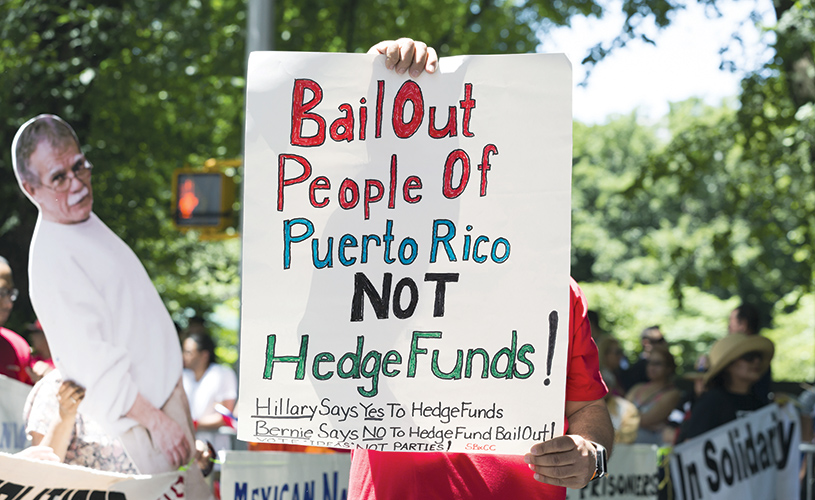

A protester during New York City's Puerto Rican Day Parade in June. (Glynnis Jones / Shutterstock.com)

Another aspect of the fiscal crisis that has not been discussed in detail is the island’s pension funds, particularly the one for central government employees and teachers, which are currently underfunded by more than $40 billion. That, combined with the fact that Medicare funding for the island’s public health plan is expected to run out by next year, could lead to more than 150,000 pensioners left with barely any income or health care.

Richard Ravitch, Padilla’s designated representative on the board, has told the local press that if the pensions are not paid, it will lead to unprecedented chaos in Puerto Rico.

“There are a lot of people who believe that if the government does not pay the pensions, that money will be used to pay the debt. I don’t think so,” Ravitch said. “There are 150,000 people eligible and the pensions cost $14 billion a year at the most. If the pensions are not paid, these people will be in an economic and social crisis, without a system to help them, and there will be social chaos. The pensions must be paid.”

The challenge for the board and local politicians is to find an adequate balance for paying the creditors and managing the central government deficit and the underfunded pension system.

And this has to be done in an economy that is shrinking, on an island where the population is aging and where migration is making the problem worse. Regardless of the solution, one of the key aspects will be for all stakeholders to understand that no sector will come out of this crisis unharmed.

“We are undergoing our worst crisis in modern history and we don’t have a clear route for the most effective way to solve it,” Vélez said, “and any solution that is implemented will require great sacrifices and will redefine what we are in the next 40 or 50 years.”