Andrew Cuomo

How the tax plan will affect New York’s politicians

Photo by Mike Groll/Office of Governor Andrew M. Cuomo

The House and Senate are set to approve an updated version of the Republican tax plan this week, which has been hastily reconciled between the two chambers and rewritten to address the needs of certain lawmakers. However, the bill will likely pass without the support of several New York lawmakers, including possibly half of the state’s Republican conference, due to provisions that punish high-tax, blue-leaning states. Here’s how New York’s politicians will fare after the legislation is passed:

RELATED: The biggest Winners & Losers of 2017

Gov. Andrew Cuomo

Cuomo has called the congressional tax plan a “dagger at the economic heart of New York” that would “rape and pillage” the state, but unfortunately for the governor, dramatic language is unlikely to prevent passage in Congress. A large portion of the state’s income tax revenue comes from high earners. The tax plan will cap the state and local tax deduction for income, property and sales taxes at $10,000, meaning that wealthy citizens who make up the state’s economic base and would no longer be able to deduct their extremely high property and income taxes. This could lead to declining housing prices in New York City, and threaten an exodus of the high earners. When constructing the budget for 2018, Cuomo is already looking at a projected $4.4 billion deficit, and now may be facing lower state revenue. Meanwhile, the ongoing transit crisis could be exacerbated if federal funding for mass transit is cut to offset the hefty $1.5 trillion price tag on the tax plan. An impending budget crisis and continuing MTA malaise, now combined with a burdensome tax plan, may make life difficult for a governor running in 2018 – and perhaps 2020.

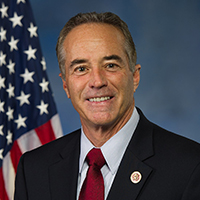

Reps. Chris Collins and Tom Reed...

Collins has long been a staunch ally of President Donald Trump, and so his full-throated support of the tax plan was only to be expected. Reed has elevated his profile as a champion of the tax plan, helping alongside Collins to craft the compromise that allowed for a $10,000 cap in state and local deductions. Reed, a member of the Ways and Means Committee, has increased his establishment cred as a key player in the negotiations. Reps. Claudia Tenney and John Katko voted for the House version of the tax plan last month, and may choose to do so again. In the short term, these Republicans will have voted for the appealingly named “Tax Cut and Jobs Act,” and will be on the winning side of a hard-fought legislative battle. The long-term effects of the bill will determine whether Collins, Reed and their cohort can truly be considered winners.

RELATED: The six GOP House seats New York Dems are targeting in 2018

Vs. the rest of the New York Congressional delegation

Rep. Lee Zeldin. (Photo via Zeldin for Congress Facebook)

It’s a given that U.S. Senate Minority Leader Charles Schumer and Sen. Kirsten Gillibrand will oppose the plan, but it must be frustrating for Schumer, fresh off a special election victory in Alabama, not to have Sen.-elect Doug Jones seated until after the bill is passed. New York’s Democratic House delegation is likely to uniformly vote against the bill. New York Republicans who oppose it are in stickier situations. Reps. John Faso and Elise Stefanik have signaled that they willoppose the bill. Both are facing Democratic challenges in the 2018 election. Rep. Peter King, who has been friendly with Trump lately, has been very outspoken against it – showing that perhaps the senior lawmaker no longer has the currency to influence presidents and affect change. Rep. Dan Donovan is being squeezed on the right in a primary from former Rep. Michael Grimm, who can hit him for not being pro-Trump enough, while also facing a Democratic challenger. Finally, Rep. Lee Zeldin has spoken out against the bill, and may need some help from dark horse ally Steve Bannon to assuage his conservative constituents after opposing the bill.

New York City Mayor Bill de Blasio

If at first you don’t succeed in trying to pass a millionaires tax, try, try again. Unless, of course, the Republican Congress decides to pass a bill that would greatly increase the tax burden on many of your city’s highest earners (assuming they’re not real estate developers). In 2014, de Blasio aimed to get universal prekindergarten financed through a tax increase on residents earning $500,000 or more, but was rebuffed by Cuomo and Senate Republicans. In August, the mayor repackaged the millionaires tax as a method for funding the MTA. However, with that pesky state and local tax deduction severely limited, even de Blasio’s allies in the Legislature aren’t enthusiastic about giving the city’s wealthiest an extra tax. Assembly Speaker Carl Heastie said that “it would be very difficult” to add an extra tax for these high earners after the Republican plan is passed. Thanks to the tax plan, de Blasio may have to shelve his millionaires tax dreams until his next big project needs funding.

NEXT STORY: The biggest political storylines of 2017