Carmen Vega-Rivera jokes that she’s spent so much time in Bronx Housing Court that she sometimes checks to see if her portrait has been put up on the walls.

After an accident coupled with health issues rendered her physically disabled, the long-time Grand Concourse resident left behind a career in education and grew more involved in tenant organizing. Then, she said, her landlord attempted to thwart her efforts with an unsuccessful lawsuit alleging non-payment of rent. She has since filed complaints over improper conditions in her building, and has seen neighbors go in and out of housing court, too. Now, with New York City studying whether to allow larger residences along a mostly commercial stretch of Jerome Avenue, Vega-Rivera said she is concerned such trips to housing court, as well as poor credit scores and other financial records, may stand between her southwest Bronx community and the affordable housing the city says it would reap through a rezoning.

“Who are you building for? To me, it’s part of racism and discrimination because what you’re doing is you know that our community is struggling,” said Vega-Rivera, a leader of the Community Action for Safe Apartments tenant organizing group, or CASA. “And what you’re doing is saying, ‘Hey, we discovered another way of keeping you out, but we are not going to tell you that we’re keeping you out; we’re going to use your credit score.’”

Many New Yorkers have expressed fears that they will get priced out of their neighborhoods through a wave of rezonings embedded in Mayor Bill de Blasio’s plan to create 200,000 units of affordable housing across the city. Along Jerome Avenue, where the median income is just under $27,000, Bronxites' concerns about any new affordable housing being prohibitively expensive are exacerbated by the potential barriers of credit score checks and housing court case reviews.

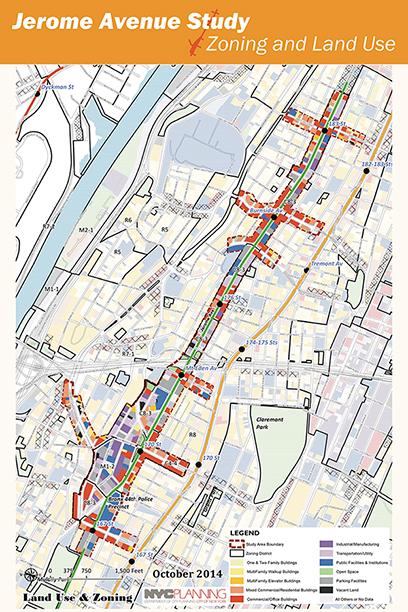

Click Map To View

Credit scores, which tend to be lower in poorer and minority communities, have historically been used in applications for city-administered affordable housing. Landlords have also reviewed housing court history and other debt in considering potential tenants.

The de Blasio administration said it has taken steps to make affordable housing more accessible, including implementing guidelines in October that forbid landlords from rejecting applicants solely based on their credit score. The administration also set parameters for when housing court records, bankruptcies and other fiscal records are serious enough to dismiss a candidate.

Still, critics say more needs to be done. CASA and other advocacy groups who drafted a policy platform focused on the Jerome Avenue rezoning are prodding the city to further limit how credit histories and other factors may be used, and are supporting related legislation.

City Councilman Mark Levine is drafting legislation that would allow developers leasing affordable units through a Department of Housing Preservation and Development-supervised lottery to review applicants’ credit history, but bar landlords from considering their credit scores, consumer debt judgments, collection accounts or medical debt.

“(Credit history) is used, currently, as a blunt tool that lumps all past credit experiences together, and we want HPD to take a more nuanced approach in which they do not consider items from a credit history that reflect one-time issues that have now been resolved, so things like medical debt,” Levine said. “We think it unfairly screens people who would otherwise be excellent candidates.”

Currently, landlords of buildings that fall under many city affordable housing programs are permitted to take an applicant’s credit score into consideration. However, landlords of units administered through HPD or the Housing Development Corporation may not reject applicants based solely on that credit score.

If an applicant’s credit score is below a certain level, landlords may reject them for filing for a bankruptcy within the past two years; having any landlord-initiated court case end in an eviction in the past four years; having monthly rent and minimum credit card, loan and other payments amount to more than half of monthly income; and having more than $3,000 in outstanding liens and court judgements without working to address liabilities through a financial recovery program. A history of failing to pay rent on time or amassing more than $500 in non-rent delinquencies can also be grounds to reject a prospective tenant’s application.

Similar but less stringent guidelines detail how landlords may handle homeless New Yorkers’ affordable housing applications. Despite the changes implemented under de Blasio, credit scores can still be used to reject homeless people if they they fail at least one of the secondary criteria.

The New Economy Project, which focuses on challenging inequality and building strong local economies, has described the use of credit scores as the next front in the civil rights movement. Citing the legacy of discriminatory practices in the mortgage and loan industry, as well as research showing race is the single best indicator of an individual’s credit score, the organization successfully pushed for recent city legislation that now bars employers from conducting credit checks in applications for most positions.

Advocates said they were unaware of research showing how often credit scores contribute to an applicant for affordable housing being rejected, but some said it is a problem.

Andy Morrison, the New Economy Project’s campaigns coordinator, said its financial justice hotline has fielded calls from people whose credit scores “did them in” on affordable housing lotteries. Vega-Rivera said she tested the lottery last year and twice discussed her credit, at which point developers asked her for a guarantor with income levels she described as unrealistic. Tim Campbell, deputy executive director for programs at the Coalition for the Homeless, said the use of credit checks outside of the supportive housing market is one of the most formidable challenges the homeless face.

“If you’re going to a homeless shelter, it’s really a last resort and you’ve exhausted all of your other options before that, so there often are debt or credit issues that someone has encountered along the way,” Campbell said. “You have to be looking at the reality of that situation and trying to consider how are you really going to be able to move people on within that context.”

Ismene Speliotis, executive director at Mutual Housing Association of New York, which develops and manages housing for low- and moderate-income New Yorkers, said the city should require landlords to be more flexible, rather than allowing them to disqualify applicants by flipping through their credit history. For instance, Speliotis said developers should have to give applicants without a credit history the chance to prove their reliability through non-traditional forms of credit, such as evidence of paying rent and various bills on time. HPD said a very small percentage of applicants do not have a credit history, and in these cases, developers tend to rely on alternative information.

Speliotis also argued the developers should be compelled to inquire about poor financial behavior within a narrow time frame and consider whether a one-time incident made it impossible for applicants to pay bills – as opposed to viewing it as a reflection of their willingness to pay. The threshold of having enough monthly income to cover more than 50 percent of monthly dues is misguided, she said, because many people applying for affordable housing are looking to move into homes where they would not be directing such a large share of their income to housing.

“There’s a sense among developers that they get so many applicants, that they might as well cherry-pick,” said Judith Goldiner, supervising attorney of the Legal Aid Society’s Civil Practice Law Reform Unit. “For apartments that we’re subsidizing, that developers are allowed to discriminate in that way seems really wrong to us.”

An HPD spokeswoman said her agency and the Housing Development Corporation spent more than a year soliciting feedback from developers, marketing agents and tenant advocates before updating their guidelines.

"No one should be turned away from affordable housing solely based ona credit score,” the HPD spokeswoman said in a written statement. “That is why the city recently established new credit criteria to prohibit developers from rejecting an applicant based on credit score alone. Going forward, developers will be required to take a deeper look at all the factors at play in an applicant's credit history because every New Yorker deserves a fair shot at the opportunity that affordable housing provides to stabilize one's life and secure a better future."

You can read New York City's rules for considering tenants in affordable housing below.